BlueCo's New Structure: A Masterstroke

By BlueCo Xtra Chief Editor

If you've been following Chelsea FC recently, you might have noticed a lot of headlines that seem designed to stir up trouble. The latest comes from Martyn Ziegler, who published an article in The Times titled:

"Chelsea’s owners lose £1bn in two years despite club’s £130m ‘profit’."

This kind of sensationalism isn’t new. He aims to drag Chelsea's name through the mud and spark confusion and frustration among the fanbase.

But here's the thing: The real story is far more complex and strategic than what’s being reported, and it's time for us to break it down.

Let’s Untangle the Web

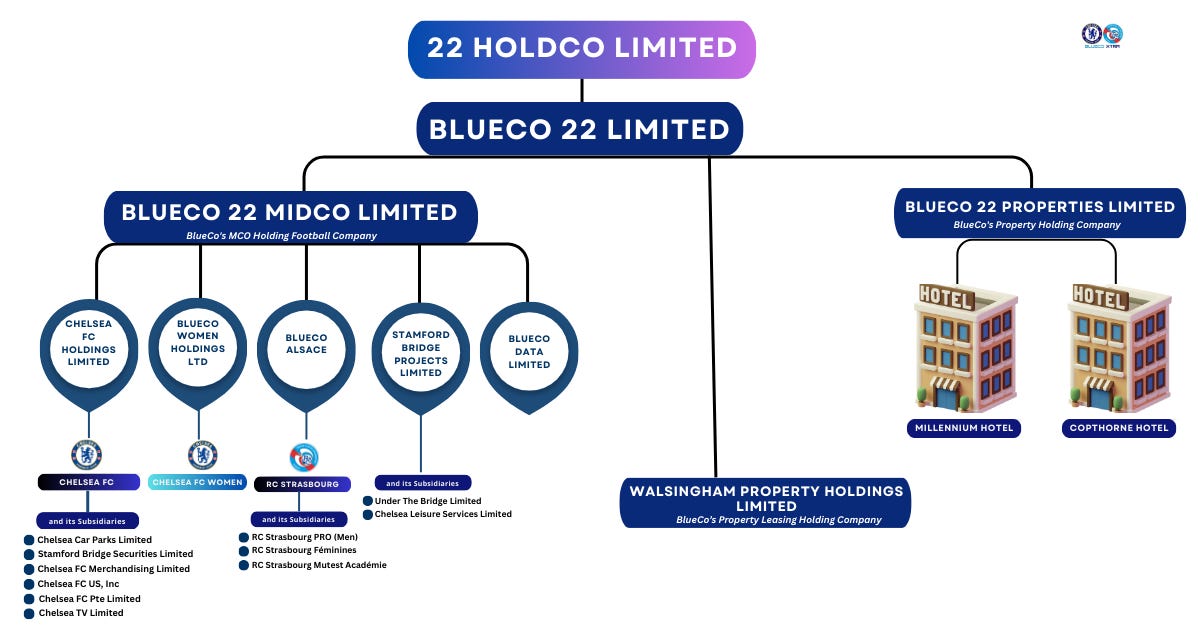

Ever since BlueCo took over Chelsea Football Club, fans have been introduced to unfamiliar corporate terms like “HoldCo,” “MidCo,” and “subsidiaries.” At first glance, it might seem like an overly complex web of companies — more confusing than helpful. But in reality, this structure is part of a well-thought-out strategy to future-proof Chelsea FC and lay the foundation for a modern, global footballing empire.

Before we get lost in the corporate jargon, let’s simplify things. BlueCo — the investment group behind Chelsea — has organized its ownership model through a series of holding companies. These aren't just arbitrary names; each one serves a specific and strategic purpose. Here’s how it all fits together:

22 HoldCo Limited is the parent company — it’s at the top of the pyramid, and everything else falls under it.

BlueCo 22 Limited is the operational vehicle that manages all of BlueCo’s investments.

Under BlueCo 22 Limited, there are three key branches:

BlueCo 22 MidCo Limited handles football-related assets, including Chelsea FC, Chelsea Women, and RC Strasbourg.

BlueCo 22 Properties Limited oversees the hotel and property investments (like the Millennium and Copthorne Hotels).

Walsingham Property Holdings Limited is focused on leasing properties.

Why All These Companies?

You might be asking, “Why so many companies?” The answer lies in the way BlueCo is managing its assets. Here’s why the structure makes a lot of sense:

Clear Focus and Specialization: Each part of the business is designed to run separately but efficiently. The football side (Chelsea, Chelsea Women, and Strasbourg) operates independently from the real estate business (the hotels), making everything more focused and manageable, unlike the cumbersome way it was under the last ownership.

Financial Protection: This restructuring provides financial protection. If one part of the business faces financial trouble — for example, if hotel revenues take a dip — it doesn’t necessarily affect the football operations and its accounts. This separation protects Chelsea from outside factors that could harm its performance both on and off the pitch.

UEFA Compliance: UEFA has strict rules about multi-club ownership, especially when the clubs play in the same competitions. By keeping Chelsea and Strasbourg in separate legal entities (Chelsea FC Holdings and BlueCo Alsace respectively), BlueCo ensures they’re in full compliance. More work may still be required at the of the season if Chelsea and Strasbourg ended up qualifying for the same UEFA tournament in the 2025/2026 season.

Attracting Investment: This structure allows investors to choose where they want to put their money. Someone interested in the football side can invest in Chelsea, Chelsea Women or Strasbourg, while someone interested in real estate can invest in the hotels. It’s a flexible approach.

Long-Term Financial Strategy: Diversified Revenue Streams

BlueCo is strategically expanding its revenue sources beyond matchday income. One key move involves the Millennium & Copthorne Hotels at Chelsea FC, which are set to undergo a significant transformation.

By the end of 2025, Ascott Limited, a prominent Singaporean real estate and hotel company, will take over the management of the 232-bedroom property. The hotel will be rebranded as the first Lyf hotel in the UK under a multi-year partnership with BlueCo 22 Properties Limited.

This shift will bring additional income to both BlueCo 22 Limited and its parent company, 22 HoldCo Limited, contributing to long-term financial stability for their football clubs. The move enhances BlueCo’s strategy to diversify revenue streams, making their football clubs more financially resilient.

Frédéric Carré, Regional General Manager for Europe at Ascott Limited, shared the significance of this partnership:

“We are really looking forward to rebranding the hotel under our lyf brand, which is known for its vibrant and community-centric living spaces. Our plans for Lyf Chelsea London include extensive renovations to enhance guest experiences and create a dynamic environment that aligns with the lyf brand’s ethos. We look forward to welcoming guests – including football fans – to this iconic location and providing them with unique and memorable stays,”

This development represents a key part of BlueCo's broader approach to ensuring Chelsea remains financially strong and well-positioned for the future.

BlueCo’s Vision for Chelsea and Beyond

BlueCo isn’t just about owning a football club. It’s about creating a sustainable, global business model that blends sports with other sectors. By separating football operations from real estate and leisure, they’re able to build a robust, multi-faceted empire:

Football (Men’s and Women’s) — Dedicated companies like Chelsea FC Holdings and BlueCo Women ensure both teams get the attention they deserve.

Multi-Club Ownership — With Chelsea, Chelsea Women and RC Strasbourg under BlueCo, they can leverage synergies between the three.

Revenue Diversification — Hotels, property leasing, and other ventures ensure that BlueCo’s success doesn’t depend solely on matchday revenues, commercial or sponsorship.

Setting the Record Straight (With Expert Clarity)

Let’s clear this up once and for all: When Martyn Ziegler or any other journalist claims “Chelsea’s owners have lost £1 billion,” they’re not talking about Chelsea FC as a standalone football club. They’re referring to 22 HoldCo Limited, the parent company of BlueCo’s entire empire — a holding entity that includes not just Chelsea, but RC Strasbourg, the women’s team structure, and even hotels and other property ventures.

Football finance expert Kieran Maguire put it perfectly when he explained:

“These loans (total borrowings of £1.16billion and is paying interest at between 7.7 and 11.96 per cent, which led to interest of more than £94million in the year to June 30, 2024) were not passed through to Chelsea FC Holdings Ltd, which instead issued £315 million of shares, which do not bear interest. Combined with the exclusion of the profit on the sale of the women’s team in the group accounts and the losses incurred at Strasbourg, this helps explain the huge difference between the profit at Chelsea and the losses at HoldCo.”

In other words, Chelsea FC is not saddled with interest-bearing loans — it has been funded through equity (which is financially healthier), and its accounts are separate from Strasbourg, Chelsea Women and other ventures.

So when Chelsea FC reports a £130 million profit, that’s real, even if HoldCo’s consolidated accounts show losses — because those losses include investments and restructuring costs across the entire BlueCo portfolio, not just Chelsea.

Thanks!! Follow our Social Media handles

X (Formerly Twitter): BlueCo Xtra

Instagram: BlueCo Xtra

Threads: BlueCo Xtra